How Financial Advisors Can Shorten the Sales Cycle for New Clients

Financial advisors can shorten the sales cycle for new client acquisitions, and it isn’t as difficult as you may think. And it doesn’t mean you have to invest large sums of money on advertisements.

On average, 92% of financial advisors say that social media helps them acquire new clients. However, this growing trend is not the most reliable method. What happens if the social media platform goes down or ceases operations?

Do you remember where you were when Facebook, Instagram, and WhatsApp were down for an entire business day on Monday, October 4, 2021? Did the shutdown of the Google+ social media platform on Tuesday, April 2, 2019, adversely affect your social media advertising?

You cannot just rely on social media marketing to acquire new clients. Other advertising methods can be costly and not provide the return on investment (ROI) you were expecting.

Advertising isn’t the only option for bringing in new business. Here are some helpful tips to help you shorten the sales cycle for onboarding new clients.

Factors That Cause Long Sales Cycles for New Client Onboarding

Before diving into solutions for shortening the sales cycle of new clients, let’s evaluate what factors contribute to a long sales cycle.

You can better understand why specific changes in your processes will be more effective by understanding the obstacles of onboarding new clients. You won’t need to drop cash on advertising or chase leads through cold calls.

First, the two main contributing factors to a long sales cycle are the situations you have limited control over and controllable items with your processes.

Limited control items include:

- Booking and keeping appointments: You are not always in control of when you or your prospects are capable of meeting.

- Paperwork: There is an insane amount of paperwork that goes into onboarding new clients and closing deals. That is the way it is. You cannot change that dynamic (but don’t lose heart, there’s a solution, and you’ll find out soon what that is).

- Underwriting time: The time involved in underwriting is another factor for which you have little control (Again, solutions are just around the corner).

There are also controllable items affecting the timeline of the sales cycle, and they include:

- Life events: Some clients won’t need immediate action on deals. For example, a client who isn’t ready to retire won’t need to cash out retirement benefits. These actionable items will remain in your pipeline. However, new clients will require you to set these situations up for them and, therefore, they become controllable items in the life cycle of a sales opportunity.

- Lack of a target market: Every business needs to know who its customers are. Defining your target market will help improve every aspect of your business. This controllable item includes the sales cycle timeline.

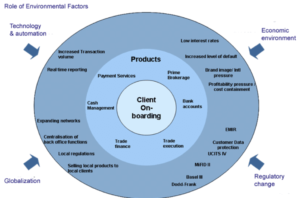

Finally, there is a third factor in the timeline of a sales cycle. Environmental factors play a role in your ability to acquire new clients. These factors include technology, economics, globalization, and regulatory changes. The chart below breaks down the role these environmental factors play.

The bottom line is that if you don’t manage the environmental factors effectively, it won’t matter if the rest of your processes are dialed-in perfectly.

5 Ways Financial Advisors Can Shorten the Sales Cycle

So, now that you have evaluated the challenges of the sales cycle, let’s assess how you can shorten the sales cycle for new clients.

1. Increase Prospect Pool

The first step in shorting the sales cycle is to increase your prospect pool. Many effective methods can help you in doing this, and you don’t need to advertise or cold call. Referrals are an effective method because word of mouth is the best form of advertising.

2. Build Relationships

Times have changed. You cannot rely on selling services over the phone. Building relationships with clients is an essential part of closing deals quickly. You can do this more effectively by meeting with your clients as soon as interest is expressed and as often as the client (and you) have time for.

3. Develop a Plan Swiftly

In this fast-paced world, information travels at lightning speed. Therefore, outreach becomes more difficult than ever for companies like yours that rely heavily on word-of-mouth recommendations or testimonials from happy customers.

Develop a plan you can present to your new client as quickly as possible. That way, they aren’t waiting around for solutions to their financial concerns.

4. Reduce Processing Time

Remember, paperwork and underwriting times are factors you have limited control over. However, providing digital methods for managing this documentation will help shorten the sales cycle tremendously. It will help you reduce processing time for some of the most time-consuming aspects of closing deals.

5. Automate Processes

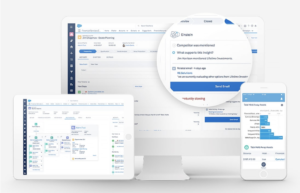

Another effective method is to provide secure solutions through automating your processes. This means incorporating software that can do just that. Salesforce has many effective automated cloud services.

One major way automation impacts your processes is by making managing paperwork easier and providing digital solutions for paperwork and underwriting tactics that were once done manually.

Financial services firms are under pressure to deliver compelling digital experiences that enable customers to manage their accounts and services securely, anywhere, and at any time, on any device. Salesforce for Finance is your solution.

Rainmaker Offers Industry Solutions You Can Rely On

At Rainmaker, we can help your firm integrate this technology into your processes. We show you how to respond quickly to customer needs, create better marketing messages personalized for each client, and generate customer referrals, all while also reducing your IT spending.

You’re looking for ways to improve your Financial Services business. Drop us a line, and we’ll be happy to help shorten your sales cycle for new clients with Salesforce.