4 Signs You Need to Revisit Your Revenue Forecasting Process

Rock Paper Scissors is famous for both its randomness and its deep strategy. While there is a winning strategy to this seemingly luck-based game, the depth of the strategy comes from both players assessing whether they think their opponent will follow this winning strategy or not. Quickly, this becomes an infinitely-recursive rabbit hole of strategy, not unlike a scene out of The Princess Bride.

The reality is that humans aren’t good at predicting the future. Try as we might, our shots in the dark are usually driven more by emotion and instinct than by rational data. That’s why revenue forecasting is essential for decision-makers across industries— technology can help us see past our blind spots.

As new technologies emerge to address new challenges, businesses must implement new strategies to handle those challenges. The revenue forecasting processes that may have been effective only a few years ago may not be making the best use of your data today.

Rather than simply identifying the next standard process, decision-makers should have a strategy for identifying when new processes are needed. Paying attention to the signs that you should revisit revenue forecasting processes provides businesses with a future-proof yardstick to measure their revenue forecasting effectiveness.

What Is Revenue Forecasting?

Revenue forecasting is the process of computing the revenue of a business over a period. Revenue forecasting uses historical data combined with forecasting methods to predict future revenues.

Not to be confused with sales forecasting, revenue forecasting focuses on the revenues a company can expect to earn, making it significantly more nuanced and complex. Sales forecasting is typically a much more straightforward process because sales forecasts don’t need to worry about things like contribution margins, stockholder dividends, or interest rates.

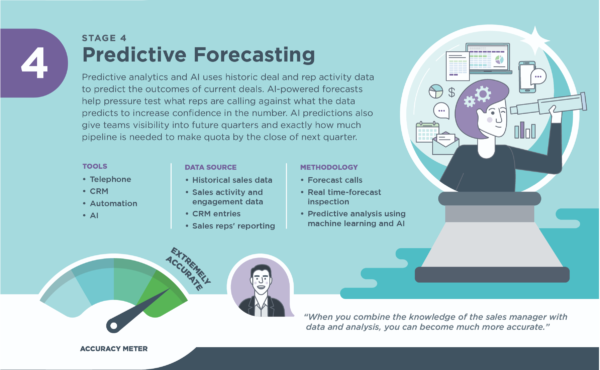

Revenue forecasting can follow many different methods ranging from the simplest straight-line approach (“we grew by 4% last year, so we will probably grow by 4% this year too”) to advanced AI-empowered predictive revenue analytics that use machine learning to find trends that might go unnoticed by even the most eagle-eyed human.

Signs You Need to Revisit Your Revenue Forecasting Process:

In today’s business world, good revenue forecasting isn’t a bonus. It’s an expectation. As data continues to grow in volume and complexity, good revenue forecasting is no trivial task, so recognizing these red flags that it may be time to reevaluate your revenue forecasting processes is essential.

1. Incompatibility with Marketing Data

Even the most seasoned businesspeople are still only human. Humans are notoriously bad at estimating, and it’s normal for decision-makers to be either overly optimistic or overly cautious about revenue forecasts.

That’s why it’s important to include “reality checks” into your revenue forecasting process. Do your forecasts line up with expected market growth? Are they in line with trends in similar businesses? Even in our deeply interconnected online world, it’s easy for businesses to become so insular that they neglect to check their findings against external data.

Revenue forecasts are a powerful tool, but they can’t offer a complete picture in a vacuum.

2. Incorrect Level of Detail

Forecasting sales and subtracting forecasted expenses may cut the mustard for a cocktail napkin estimate, but in-depth revenue forecasting requires more sophisticated considerations.

Different products and services may call for different levels of granularity when it comes to forecasting revenue. Discrete dimensions of your forecast may be more important than others, and taking the volume and variance of your various entities into consideration may require different levels of detail for different situations.

For example, a manufacturer with a high-volume, fast-turnaround product may only require a straight-line forecast as individual consumer habits are less important, whereas a customizable, bespoke product with a long processing time requires more detail and consideration.

Identifying the correct level of detail for the various dimensions of your organization is the key to evaluating what kind of revenue forecasting will be most effective, and when your revenue forecasts don’t meet the appropriate level of detail, that’s a sign to revisit your forecasting processes.

3. Not Enough Predictive Data

Whether they realize it or not, every child has encountered the dangers of forecasting with too little predictive data, and it goes something like this: “If one chocolate makes me feel good, maybe 100 chocolates will make me feel 100 times as good!”

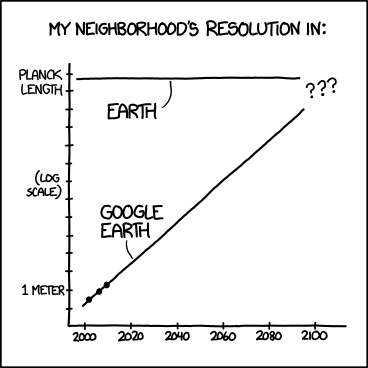

While most people encounter inappropriate extrapolation at an early age, it’s a difficult habit to grow out of. As data is an increasingly important part of the business world, decision-makers are in an arms race to leverage their data to a greater extent than their next competitor.

However, forecasts based on insufficient predictive data can leave decision-makers misinformed and result in costly mistakes.

The great question then becomes: how do you know when you have enough data?

Analysts at Anamind suggest that two years of consumer or business data is enough to make a forecast but may miss some of the nuances of economic cycles and trends. While longer data ranges give more advanced insight into sales patterns, two years of data is enough to accurately capture seasonal trends and the overall trajectory of sales and revenue.

However, as AI grows more advanced, predictive analytics tools are also equipped with metrics to measure a forecast’s reliability. Some experts suggest three to five years, but AI helps signify when it may be time to revisit your revenue forecasting process.

4. Cultural Challenges

While Business Intelligence is growing by leaps and bounds, many personnel haven’t kept up with shifting priorities. When employees and managers don’t take budgeting and forecasting seriously, it results in bad data, which fuels bad results.

This can be one of the more difficult hurdles to overcome as changing an office’s culture can feel like turning around a cargo ship, but as time goes on, it becomes more and more important that your entire team embraces and prioritizes budgeting and forecasting as an essential part of your office culture.

How Rainmaker Can Help You Make the Most of Your Data

No matter what industry you’re in, Rainmaker has the expertise and capability to help you create value. Whether you need help with strategy alignment, Salesforce management, or fully-managed product delivery, Rainmaker has a team of experts ready to take your business to the next level.

If you’re ready to learn more about how Rainmaker can help you, contact Rainmaker today to learn more about their range of services, chat with a team member, or find a time to discuss what they can do for your business.